“Bird’s continued momentum through the second quarter, with over 27% revenue growth and further margin accretion, is a direct result of the Company’s strategy, strong team and the quality of our collaborative work programs and Backlog. Our strategic focus on key sectors, coupled with strong execution and disciplined project selection is driving performance, and supports our expectations for continued growth and margin expansion through the remainder of 2024 and beyond,” stated Teri McKibbon, President and CEO of Bird Construction. “Bird’s recently announced acquisition of Jacob Bros Construction adds another catalyst for growth and profitability. With top tier leadership, a strong team and deep relationships in the British Columbia infrastructure market, we are excited by the new opportunities this partnership will bring.”

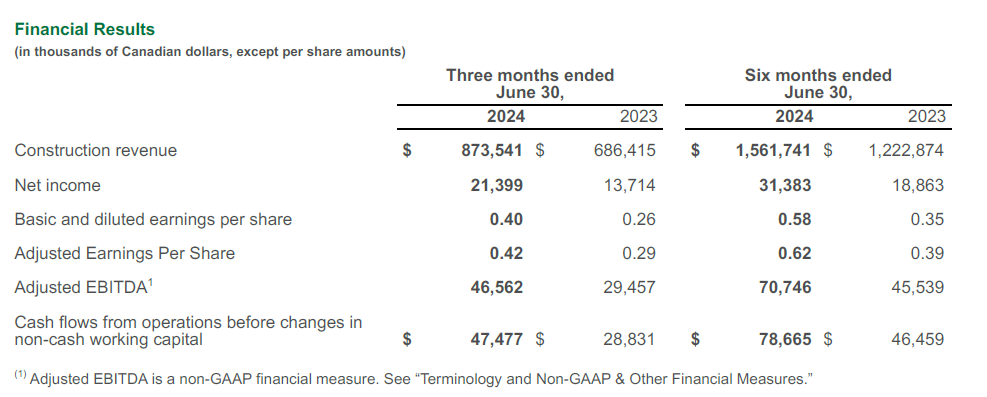

FINANCIAL HIGHLIGHTS

Bird's second quarter continued to deliver substantial revenue and earnings growth, with the Company executing record-high volumes of work in the quarter, and delivering earnings growth that continued to significantly outpace revenue growth. The Company maintained near-record Backlog levels at quarter end, securing over $822 million of new work during the quarter, and added over $304 million to Pending Backlog, which continues to include almost $0.9 billion of recurring revenue contracts. The record levels of combined backlog reflect Bird's reputation as a go-to partner for collaborative delivery of sophisticated, complex projects, and support the Company's outlook for significant revenue and earnings growth for the remainder of 2024 and beyond.

Second Quarter 2024 compared to Second Quarter 2023

• Construction revenue of $873.5 million earned in the quarter compared to $686.4 million earned in the prior year quarter, representing a 27% increase year-over-year.

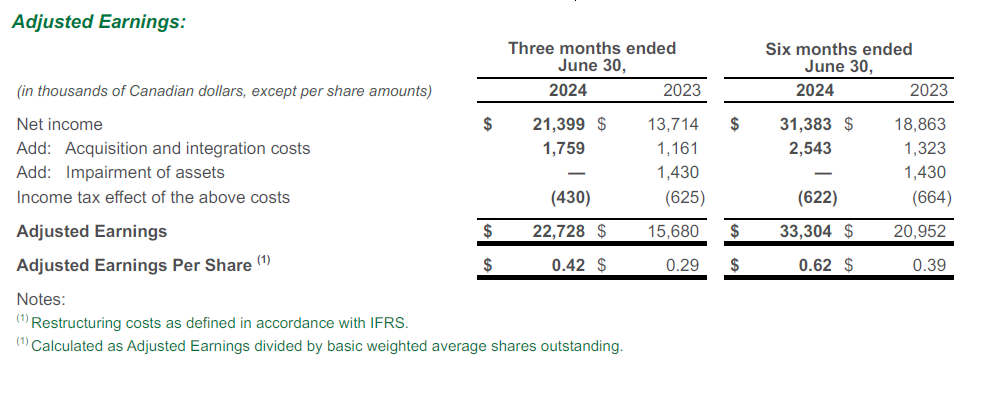

• Net income and earnings per share were $21.4 million and $0.40 in Q2 2024, compared to $13.7 million and $0.26 in Q2 2023, representing increases of 56%.

• Adjusted Earnings1 and Adjusted Earnings Per Share were $22.7 million and $0.42 in Q2 2024, compared to $15.7 million and $0.29 in Q2 2023, representing increases of 45%.

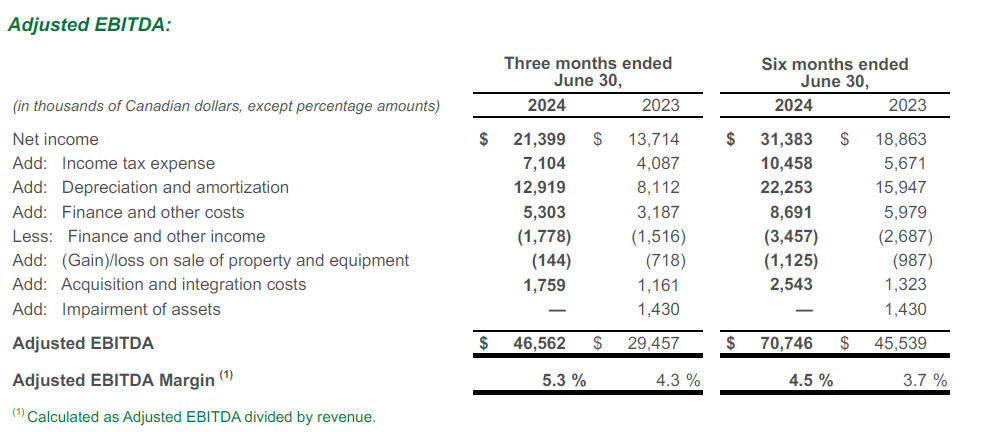

• Adjusted EBITDA1 of $46.6 million, or 5.3% of revenues, compared to $29.5 million, or 4.3% of revenues in Q2 2023, representing an increase of 58%.

Year-to-Date 2024 compared to Year-to-Date 2023

• Construction revenue of $1,561.7 million was earned in 2024, compared to $1,222.9 million in 2023, representing a 28% increase year-over-year.

• Net income and earnings per share for the year were $31.4 million and $0.58, compared to $18.9 million and $0.35 in 2023, representing increases of 66%.

• Adjusted Earnings1 and Adjusted Earnings Per Share were $33.3 million and $0.62 in 2024, compared to $21.0 million and $0.39 in the prior year, representing increases of 59%.

• Adjusted EBITDA1 for 2024 was $70.7 million, or 4.5% of revenues, compared to $45.5 million, or 3.7% of revenues in 2023, representing an increase of 55%.

HIGHLIGHTS

• Bird continued to deliver significant revenue growth in the second quarter of 2024, with over 90% of the 27% growth from organic sources. Year over year revenue growth also benefited from NorCan, acquired on January 18, 2024.

• The Company's margin profiles in the second quarter of 2024 continued to improve compared to the prior year, with Gross Profit Percentage increasing to 8.6% compared to 7.9%, and Adjusted EBITDA Margin increasing to 5.3% from 4.3%.

• Bird added over $822 million in securements to its Backlog in the second quarter ($1.5 billion year-to-date), maintaining near-record Backlog levels of $3.4 billion at June 30, 2024. Pending Backlog of work awarded but not yet contracted grew 10% in the second quarter (22% year-to-date) to $3.7 billion, and continues to include almost $900 million of MSA and other recurring revenue to be earned over the next six years.

• Operational cash flow generation was strong in the quarter, generating $47.5 million before investments in non-cash working capital, a 65% increase over the $28.8 million generated in the second quarter of 2023. Increased investment in non-cash working capital was driven by the Company's significant growth in the quarter, a higher proportion of self perform work executed and timing differences.

• On June 10, 2024 Bird announced that it had entered into an agreement to acquire British Columbia based Jacob Bros Construction (“Jacob Bros”) for estimated aggregate consideration of $135 million consisting of the issuance of 1.49 million Bird common shares, $97.2 million in cash, and the assumption of approximately $4.0 million of equipment debt. Jacob Bros is a privately-owned civil infrastructure construction business with significant self-perform capability serving both public and private clients, and has a strong, people-first culture that aligns with Bird's own. Jacob Bros specializes in civil infrastructure construction across a wide array of projects, such as airports, seaports, rail, bridges and structures, earthworks, energy projects, and utilities. Additionally, Jacob Bros delivers expertise in specialized projects that require innovative, purpose-built, custom solutions that leverage their suite of comprehensive services. The acquisition was completed on August 1, 2024.

• In connection with the announcement of the Jacob Bros acquisition, the Company amended its Syndicated Credit Facility, extending the maturity to December 15, 2027, expanding the size of the revolving facility to $300.0 million, and adding the availability of a new $125.0 million term loan facility which was used to repay existing term loan facilities and fund a portion of the Jacob Bros cash consideration. In addition, the Company expanded the non-committed accordion feature to $100.0 million.

• During the second quarter of 2024, the Company announced that it was awarded five projects with a total combined value of over $625 million. These projects include multi-year mine infrastructure work in Eastern Canada and three long term care projects and a multi-building institutional project in Western Canada.

• The Board has declared eligible dividends of $0.0467 per common share for each of August 2024, September 2024 and October 2024.

CONFERENCE CALL AND WEBCAST

Bird will host an investor webcast to discuss the quarterly results on Thursday, August 8, 2024 at 10:00 a.m. ET, to discuss the Company’s results. Analysts and investors may connect to the webcast at https://event.choruscall.com/mediaframe/webcast.html?webcastid=Gw1wc4g5. They may also dial 1-844-763-8274 for audio only or to enter the question queue; attendees are asked to be on the line 10 minutes prior to the start of the call. The presentation can also be found on our website at https://www.bird.ca/investors.

The Company’s financial statements and Management’s Discussion & Analysis (“MD&A”) will be filed and available on the System for Electronic Document Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca and on the Company’s website at www.bird.ca.

TERMINOLOGY AND NON-GAAP & OTHER FINANCIAL MEASURES

Throughout this News Release, certain terminology and financial measures are used that do not have standard meanings under IFRS and are considered specified financial measures. These include non-GAAP financial measures, non-GAAP financial ratios, and supplementary financial measures. These measures may not be comparable with similar measures presented by other companies. Further information on these financial measures can be found in the “Terminology and Non-GAAP & Other Financial Measures” section in Bird’s most recently filed Management’s Discussion & Analysis for the period ended June 30, 2024, prepared as of August 7, 2024. This document is available on Bird’s SEDAR+ profile, at www.sedarplus.ca and on the

Company’s website at www.bird.ca.

“Backlog” is the total value of all contracts awarded to the Company, less the total value of work completed on these contracts as of the date of the most recently completed quarter. The Company’s Backlog equates to the Company’s remaining performance obligations as at June 30, 2024 and December 31, 2023.

“Adjusted Earnings” and “Adjusted EBITDA” are non-GAAP financial measures. “Adjusted Earnings Per Share” and “Adjusted EBITDA margin” are non-GAAP financial ratios. “Pending Backlog” is a supplementary financial measure.

Adjusted Earnings and Adjusted EBITDA are reconciled as follows:

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and information ("forward-looking statements") within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this news release are based on the expectations, estimates and projections of management of Bird as of the date of this

news release unless otherwise stated. The use of any of the words "believe", "expect", "anticipate", "contemplate", "target", "plan", "intend", "continue", "may", "will", "should" and similar expressions are intended to identify forward-looking statements and information. More particularly and without limitation, this news release contains forward-looking statements concerning: anticipated financial performance; the outlook for 2024; expectations for Adjusted EBITDA Margins in 2024 and beyond; dividend rates, their sustainability, and expected dividend payout ratios; expectations with respect to anticipated revenue growth and seasonality, growth in earnings, cash flow, earnings per share and adjusted EBITDA in 2024 and beyond, and margin improvements; the ability of the Company to further leverage its cost structure; the Company’s ability to capitalize on opportunities and grow profitably; the robustness of near to medium term demand in core markets; future opportunities related to the acquisition of Jacob Bros; expectations regarding the Jacob Bros acquisition impact to Bird’s business, anticipated financial performance of Jacob Bros and its impact to the Company’s operations and financial performance, including the anticipated accretive value to Bird, the sufficiency of

working capital and liquidity to support growth and finance future capital expenditures; and with respect to Bird’s ability to convert Pending Backlog to Backlog and the timing of conversions.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to the risks associated with the industries in which the Company operates in general such as: the ability to hire and retain qualified and capable personnel, maintaining safe work sites, economy and cyclicality, ability to secure work, performance of subcontractors, accuracy of cost to complete estimates, estimating costs and schedules/assessing contract risks, adjustments and cancellations of Backlog, global pandemics, joint venture risk, information systems and cyber-security risk, litigation/potential litigation, work stoppages, strikes and lockouts, acquisition and integration risk, competitive factors, potential for non-payment, climate change risks and opportunities, access to capital, quality assurance and quality control, design risks, insurance risk, access to surety support and other contract security, completion and performance guarantees, ethics and reputational risk, compliance with environmental laws, and internal and disclosure controls.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of the parties, and the combined company are included in reports on file with applicable securities regulatory authorities, including but not limited to; Bird's Annual Information Form and Management’s Discussion and Analysis for the year ended December 31, 2023, each of which may be accessed on Bird’s SEDAR+ profile, at www.sedarplus.ca and on the Company’s website at www.bird.ca.

The forward-looking statements contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as, and to the extent required by applicable securities laws.

The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

For further information, please contact:

T.L. McKibbon, President & CEO or

W.R. Gingrich, CFO

Bird Construction Inc.

5700 Explorer Drive, Suite 400

Mississauga, ON L4W 0C6

Phone: (905) 602-4122

ABOUT BIRD CONSTRUCTION

Bird (TSX: BDT) is a leading Canadian construction and maintenance company operating from coast-to-coast-to-coast. Servicing all of Canada's major markets through a collaborative, safety-first approach, Bird provides a comprehensive range of construction services, self-perform capabilities, and innovative solutions to the industrial, buildings, and infrastructure markets. For over 100 years, Bird has been a people-focused company with an unwavering commitment to safety and a high level of service that provides long-term value for all stakeholders. www.bird.ca