COMPANY: BIRD CONSTRUCTION INC.

LISTING: TORONTO STOCK EXCHANGE

CITY: MISSISSAUGA

SYMBOL: BDT

DATE: August 9, 2023

SUBJECT: BIRD CONSTRUCTION INC. ANNOUNCES 2023 SECOND QUARTER FINANCIAL RESULTS

“Bird's strong second quarter financial performance coupled with almost $1 billion in contract bookings highlight the advantages of the Company’s strategic focus on being a leading collaborative construction company. Working closely and transparently with our customers and partners drives better outcomes with lower financial and project risk, benefiting all parties involved. The Company’s growing combined backlog, with favourable embedded margins, remains highly collaborative in nature and supports Bird’s confidence in continued revenue growth and margin expansion for the second half of the year and beyond,” stated Teri McKibbon, President and CEO of Bird Construction. “The commitment of our entire Bird team to drive collaboration, cross-selling and diversification across the organization is paying dividends. The Company grew revenue 19% in the quarter versus last year and delivered over $7 million in cash from operating activities, an almost $80 million improvement from 2022. With a strong balance sheet, we continue to support investments in the Company’s future growth, both organically and through opportunistic tuck-in acquisitions.”

Bird's second quarter of 2023 delivered significant organic revenue growth while gross profit and EBITDA margins strengthened compared to both the first quarter of the year and to the same quarter of last year. The Company reported the highest quarterly revenue in its history, while at the same time continuing to grow its Backlog and Pending Backlog of future work to new record combined levels. Bird continues to drive growth through its diversified and risk-balanced business model, with expanding cross-selling opportunities across its service offerings, and robust, accretive performance from recent acquisitions. Bird generates the majority of revenues from lower risk contract types, has limited exposure to lump sum turnkey projects and minimal work in interest-rate sensitive residential and commercial construction markets.

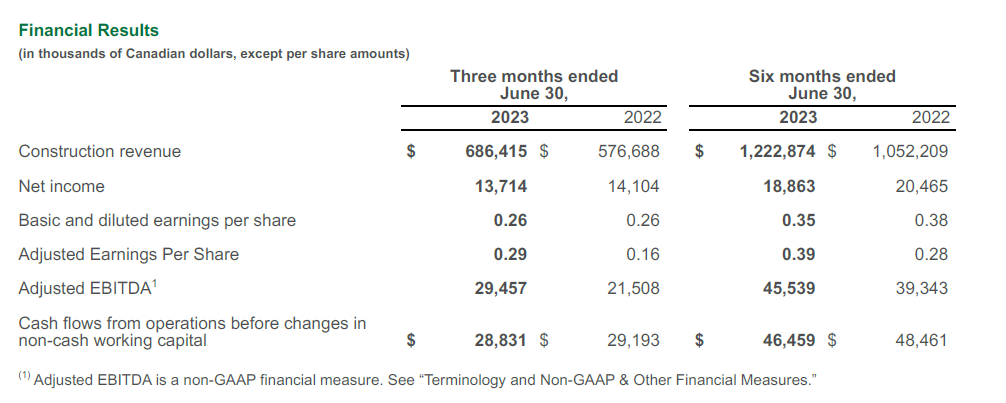

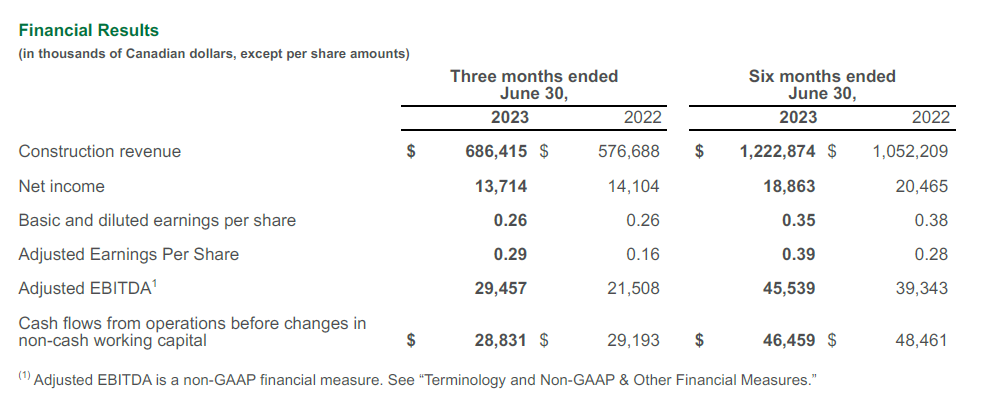

Second Quarter 2023 compared to Second Quarter 2022

- Construction revenue of $686.4 million compared to $576.7 million, representing a 19.0% increase year-over-year.

- Net income and earnings per share were $13.7 million and $0.26, respectively, compared to $14.1 million and $0.26 in Q2 2022.

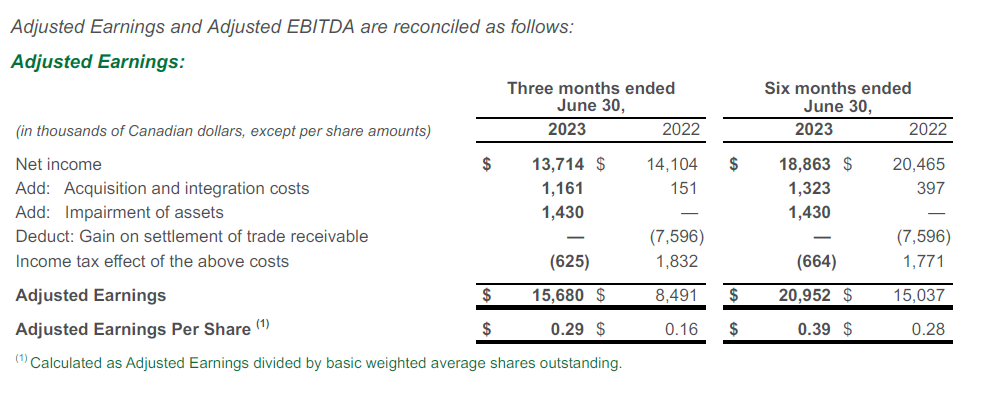

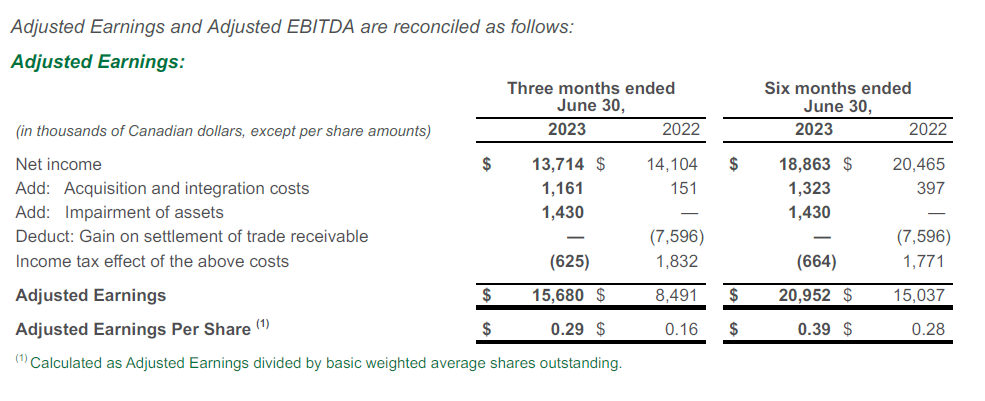

- Adjusted Earnings1 and Adjusted Earnings Per Share1 were $15.7 million and $0.29, respectively, compared to $8.5 million and $0.16 in Q2 2022.

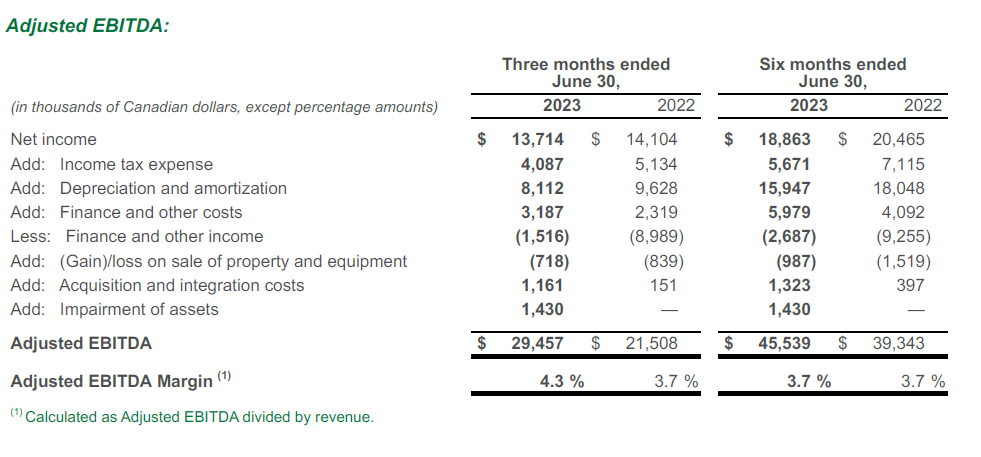

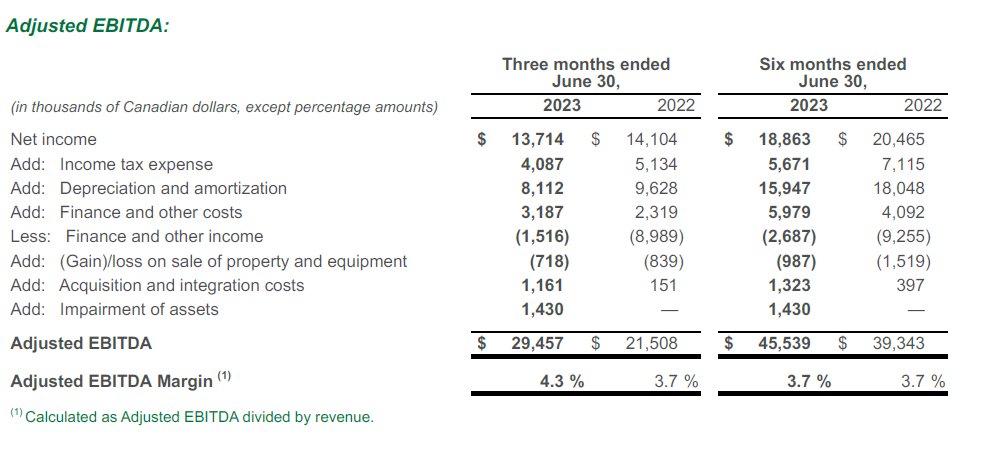

- Adjusted EBITDA1 of $29.5 million, or 4.3% of revenues, compared to $21.5 million, or 3.7% of

revenues in Q2 2022.

Year-to-date 2023 compared to Year-to-date 2022

- Construction revenue of $1,222.9 million was earned in the first six months of 2023, compared to $1,052.2 million in 2022, representing a 16.2% increase year-over-year.

- Net income and earnings per share for the first half year were $18.9 million and $0.35, respectively, compared to $20.5 million and $0.38 in 2022.

- Adjusted Earnings1 and Adjusted Earnings Per Share were $21.0 million and $0.39 year-to-date in 2023, respectively, compared to $15.0 million and $0.28 in the prior year.

- Adjusted EBITDA1 for the first six months of 2023 was $45.5 million, or 3.7% of revenues, compared to $39.3 million, or 3.7% of revenues in 2022.

HIGHLIGHTS

- Bird executed a record amount of work in the second quarter of 2023, delivering revenues of $686.4 million driven predominantly by organic growth, with additional contributions from Trinity, acquired on February 1, 2023.

- The Company's margin profile continued to improve in the quarter compared to the prior year, with Gross Profit Percentage increasing to 7.9% and Adjusted EBITDA Margin increasing to 4.3%, from 7.5% and 3.7%, respectively, in the second quarter of 2022.

- Bird added almost $1.0 billion in securements to its Backlog during the quarter ($1.6 billion year-to-date), growing the Company's Backlog to $3.0 billion at June 30, 2023. The Company's Pending Backlog also grew by $106.5 million during the quarter to $3.1 billion, and includes approximately $1.1 billion of Master Service Agreement ("MSA") and recurring revenue work to be performed over the next seven years.

- Bird maintains a strong liquidity position at June 30, 2023, with operational cashflows for the quarter funding not only the growth in the Company's work program, but also productivity and project-driven capital expenditures and net repayments of debt. Bird ended the second quarter with $107.1 million of cash and cash equivalents and an additional $172.0 million available under the Company's Syndicated Credit Facility.

- During the second quarter of 2023, the Company announced that it was awarded the following projects and contracts:

- Bird was awarded $300 million in additional recurring MSA work, including a new seven-year MSA for multi-discipline bundled services across a client’s maintenance, turnarounds and sustaining capital programs, and contract extensions with additional services and scope on existing MSAs ranging from three to five years. Similar to other MSA awards, the value will reside in Pending Backlog and be converted to Backlog over time as purchase orders are received against the MSAs.

- Bird was awarded a construction management services contract valued at approximately $50 million for BC Housing’s Permanent Supportive Housing Initiative, located in Vancouver, BC. The project, supported by Bird's pre-construction design services and with a final design delivered in conjunction with Bird's Stack Modular business, will be the first modular project of this height in Canada, delivering a volumetric steel modular tower with 14 floors of quality units on a rapid, repeatable scale. The project will follow the Passive House green building design standard, and the modular approach, with off-site design and construction of the units, substantially reduces construction time and reduces the impact on the local community during construction.

- Bird was selected as the successful proponent for Lot 1: Coarse Tailing Dam Raise project by Quebec Iron Ore. The work will be completed at the Bloom Lake Mine in Fermont, Quebec, one of the five largest iron ore mines in Canada.

- Bird was awarded the BC Ferries' FMU Redevelopment Project, including the renovation of five existing buildings and the replacement of several older buildings, including the existing machine shop, with a state-of-the-art multipurpose machine shop expanding the existing operational space by almost three times.

- Subsequent to the quarter end, the Company announced that it was awarded the following projects and contracts:

- Bird was awarded multiple contracts for industrial and civil work in the energy and mining sectors valued at approximately $180 million, including a contract for civil and concrete scopes to support processing infrastructure development at the Blackwater Mine project in central British Columbia, two contracts for rehabilitation work on hydroelectric power-related structures in northeastern Ontario, and a contract for final site earthworks, grading and asphalt paving at an existing project site in northwestern British Columbia.

- Bird was selected as the preferred proponent for the Southern Alberta Institute of Technology’s (SAIT) Campus Centre Redevelopment Project, the Victor Philip Dahdaleh Hall project at St. Francis Xavier University, and two long-term care facilities in Nova Scotia. The combined value of the contracts is over $350 million.

- The Board has declared eligible dividends of $0.0358 per common share for each of August, September and October 2023.

CONFERENCE CALL AND WEBCAST

The Company’s financial statements and Management’s Discussion & Analysis (“MD&A”) will be filed and available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and on the Company’s website at

www.bird.ca.

TERMINOLOGY AND NON-GAAP & OTHER FINANCIAL MEASURES

Throughout this News Release, certain terminology and financial measures are used that do not have standard meanings under IFRS and are considered specified financial measures. These include non-GAAP financial measures, non-GAAP financial ratios, and supplementary financial measures. These measures may not be comparable with similar measures presented by other companies. Further information on these financial measures can be found in the “Terminology and Non-GAAP & Other Financial Measures” section in Bird’s most recently filed Management’s Discussion & Analysis for the period ended June 30, 2023, prepared as of August 9, 2023. This document is available on Bird’s SEDAR profile, at www.sedar.com and on the Company’s website at www.bird.ca.

“Backlog” is the total value of all contracts awarded to the Company, less the total value of work completed on these contracts as of the date of the most recently completed quarter. The Company’s Backlog equates to the Company’s remaining performance obligations as at June 30, 2023 and December 31, 2022.

“Adjusted Earnings” and “Adjusted EBITDA” are non-GAAP financial measures. “Adjusted Earnings Per Share” and “Adjusted EBITDA margin” are non-GAAP financial ratios. “Pending Backlog” is a supplementary financial measure.

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and information ("forward-looking statements") within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this news release are based on the expectations, estimates and projections of management of Bird as of the date of this news release unless otherwise stated. The use of any of the words "believe", "expect", "anticipate", "contemplate", "target", "plan", "intend", "continue", "may", "will", "should" and similar expressions are intended to identify forward-looking statements and information. More particularly and without limitation, this news release contains forward-looking statements concerning: anticipated financial performance; the future performance of acquired entities; the outlook for 2023; expectations with respect to anticipated revenue growth, growth in earnings per share and adjusted EBITDA in 2023 and beyond, and margin improvements; the Company’s ability to capitalize on opportunities and grow profitably; the demand for the Company's modular business; the sufficiency of working capital; and with respect to Bird’s ability to convert Pending Backlog to Backlog and the timing of conversions.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to the risks associated with the industries in which the Company operates in general such as: the ability to hire and retain qualified and capable personnel, maintaining safe work sites, economy and cyclicality, ability to secure work, global pandemics, performance of subcontractors, accuracy of cost to complete estimates, estimating costs and schedules/assessing contract risks, adjustments and cancellations of Backlog, work stoppages, strikes and lockouts, acquisition and integration risk, potential for non-payment, litigation/potential litigation, design risks, information systems and cyber-security risk, competitive factors, completion and performance guarantees, access to capital, quality assurance and quality control, access to surety support and other contract security, insurance risk, climate change risk, joint venture risk, ethics and reputational risk, compliance with environmental laws, internal and disclosure controls, and payment of dividends.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of the parties, and the combined company are included in reports on file with applicable securities regulatory authorities, including but not limited to; Bird's Annual Information Form and Management’s Discussion and Analysis for the year ended December 31, 2022, each of which may be accessed on Bird’s SEDAR profile, at www.sedar.com and on the Company’s website at www.bird.ca.

The forward-looking statements contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as, and to the extent required by applicable securities laws.The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

For further information, please contact:

T.L. McKibbon, President & CEO or

W.R. Gingrich, CFO

Bird Construction Inc.

5700 Explorer Drive, Suite 400

Mississauga, ON L4W 0C6

Phone: (905) 602-4122

ABOUT BIRD CONSTRUCTION

Bird (TSX: BDT) is a leading Canadian construction company operating from coast-to-coast and servicing all of Canada’s major markets. Bird provides a comprehensive range of construction services from new construction for industrial, commercial, and institutional and civil infrastructure markets; to industrial maintenance, repair and operations services, heavy civil construction, and mine support services; as well as vertical infrastructure including, electrical, mechanical, and specialty trades. For over 100 years, Bird has been a people-focused company with an unwavering commitment to safety and a high level of service that provides long-term value for all stakeholders. www.bird.ca

1 This News Release contains terminology and financial measures that do not have standard meanings under IFRS and may not be comparable with similar measures presented by other companies. Further information regarding these measures can be found in the “Terminology and Non-GAAP & Other Financial Measures” section of this News Release.