COMPANY:

BIRD CONSTRUCTION INC.

LISTING: TORONTO STOCK EXCHANGE

CITY: MISSISSAUGA

SYMBOL:

BDT

DATE: August 10, 2021

SUBJECT:

BIRD CONSTRUCTION INC. ANNOUNCES 2021 SECOND QUARTER FINANCIAL RESULTS

The second quarter of 2021 was very strong for the Company. We reported our eleventh successive quarter of trailing twelve month Adjusted EBITDA margin improvement and our combined Backlog reached a new record high. We are extremely pleased with the acquisition of Stuart Olson as the integration is on track and it is contributing positively to the bottom line. Additionally, we are witnessing increasingly greater cross-selling opportunities emerge as the list of combined project pursuits continues to grow, said Mr. Teri McKibbon, President and CEO, Bird Construction. The Company's strategic focus in the past several years to balance the risk profile of our work program and further diversify the Company both geographically and with new service offerings continues to bear fruit. This, combined with higher recurring revenue streams, a record combined Backlog and a key focus on margin expansion, positions Bird to continue to deliver strong financial performance as market conditions improve and with government spending expected to rise.

FINANCIAL HIGHLIGHTS

Second Quarter 2021 compared to Second Quarter 2020

- Construction revenue of $556.4 million, representing a 96.8% increase year-over-year.

- Net income and earnings per share were $13.6 million and $0.26, respectively, compared to $5.6 million and $0.13 in Q2 2020.

- Adjusted Earnings(1) and Adjusted Earnings Per Share(1) were $15.0 million and $0.28, respectively, compared to $6.6 million and $0.15 in Q2 2020.

- Adjusted EBITDA(1) of $30.1 million, or 5.4% of revenues, reflects a 144.3% increase in Adjusted EBITDA and a 105 bps improvement in Adjusted EBITDA Margin(1).

- Record Backlog of $2,709.3 million and Pending Backlog of $1,647.6 million at June 30, 2021.

- Strong balance sheet with $142.7 million of working capital at June 30, 2021.

Year-to-date 2021 compared to Year-to-date 2020

- Construction revenue of $1,001.0 million, representing a 65.6% increase year-over-year.

- Net income and earnings per share were $20.7 million and $0.39, respectively, compared to $6.7 million and $0.16 in 2020.

- Adjusted Earnings and Adjusted Earnings Per Share were $24.1 million and $0.45 respectively, compared to $7.7 million and $0.18 in 2020.

- Adjusted EBITDA of $51.2 million, or 5.1% of revenues, reflects a 157.2% increase in Adjusted EBITDA and a 180 bps improvement in Adjusted EBITDA Margin year-over-year.

OVERVIEW

- During the second quarter of 2021, the Company recorded net income of $13.6 million on construction revenue of $556.4 million compared with net income of $5.6 million on $282.8 million of construction revenue in the second quarter of 2020. Basic and diluted earnings per share in the second quarter of 2021 and 2020 was $0.26 and $0.13, respectively. The year-over-year increase in second quarter revenue is primarily attributable to the inclusion of Stuart Olson. The Company’s work programs also experienced a moderate increase in activity and revenue for projects that were previously temporarily delayed by clients as a result of the COVID-19 pandemic. The year-over-year increase in net income reflects a combination of additional margin from the acquisition of Stuart Olson, inclusive of synergies, as well as progress with diversifying the work program and improving year-over-year margins in operations. Additionally, the Company recognized a pre-tax compensation expense recovery of $8.9 million for the Canada Emergency Wage Subsidy (“CEWS”) program in the second quarter of 2021, which helped to offset additional costs incurred by the Company related to the pandemic.

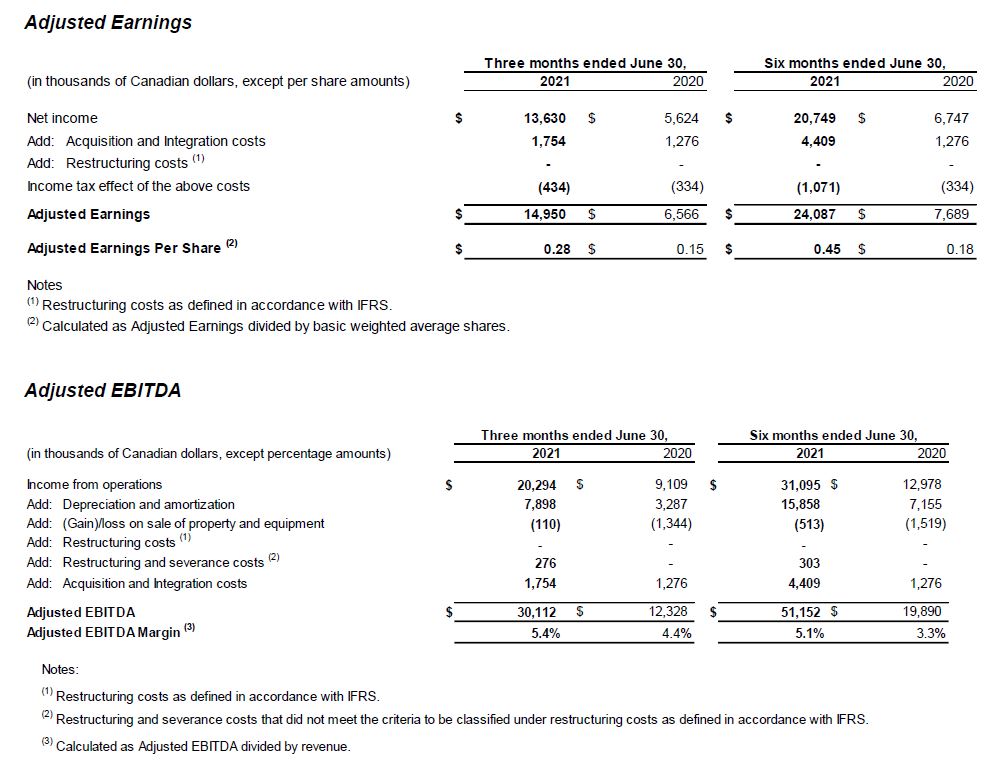

- Adjusted Earnings and Adjusted Earnings Per Share in the second quarter of 2021 were $15.0 million and $0.28, respectively, compared with Adjusted Earnings and Adjusted Earnings Per Share in the second quarter of 2020 of $6.6 million and $0.15, respectively. The year-over-year increase in second quarter Adjusted Earnings is reflective of the improvement in net income described above and the year-over-year increase for $0.4 million of tax effected integration and restructuring expenses incurred in the second quarter of 2021.

- Adjusted EBITDA and Adjusted EBITDA Margin in the second quarter of 2021 were $30.1 million and 5.4%, respectively. Adjusted EBITDA increased $17.8 million from the Adjusted EBITDA of $12.3 million in the second quarter of 2020. Adjusted EBITDA Margin increased 105 basis points from the Adjusted EBITDA margin of 4.4% recorded in the second quarter of 2020.

- During the first half of 2021, the Company recorded net income of $20.7 million on construction revenue of $1,001.0 million compared with net income of $6.7 million on $604.4 million of construction revenue in 2020. Basic and diluted earnings per share in the first half of 2021 and 2020 was $0.39 and $0.16, respectively. The year-over-year increase in revenue is primarily attributable to the inclusion of Stuart Olson. Revenues were negatively impacted in the first half of 2021 by approximately $116.0 million due to both public health restrictions and delays in permitting associated with the COVID-19 pandemic. The year-over-year increase in net income reflects a combination of additional margin from the acquisition of Stuart Olson, inclusive of synergies, as well as progress in diversifying the work program and improving year-over-year margins in operations. Net income in the first half of 2021 was impacted negatively by reduced productivity and project delays resulting from the pandemic, which had a significant unfavourable impact on earnings and were mitigated by a pre-tax compensation expense recovery of $20.1 million recognized in the first half of 2021 for CEWS.

- Adjusted Earnings and Adjusted Earnings Per Share in the first half of 2021 were $24.1 million and $0.45, respectively, compared with Adjusted Earnings and Adjusted Earnings Per Share in the first half of 2020 of $7.7 million and $0.18, respectively. The year-over-year increase in Adjusted Earnings is reflective of the improvement in net income described above and the year-over-year increase of $2.4 million of tax effected integration and restructuring expenses incurred in the first half of 2021.

- Adjusted EBITDA and Adjusted EBITDA Margin in the first half of 2021 were $51.2 million and 5.1%, respectively. Adjusted EBITDA increased $31.3 million from the Adjusted EBITDA of $19.9 million in the first half of 2020. Adjusted EBITDA Margin increased 180 basis points from the Adjusted EBITDA margin of 3.3% recorded in the first half of 2020.

- During 2021, the Company secured $1,027.8 million of new contract awards and change orders and executed $1,001.0 million of construction revenues. The Company’s record Backlog of $2,709.3 million at June 30, 2021 increased slightly from Backlog of $2,682.5 million at December 31, 2020, however Backlog remains relatively flat due to COVID-19 timing delays in project tenders and awards from clients.

- During the second quarter of 2021, the Company announced that it was awarded the following projects and contracts:

- The Company was awarded a $172.0 million fixed price construction services contract with Concert Properties for the Sherbourne Project ("The Burke") in Toronto, Ontario. The Burke is a residential tower consisting of 53 floors and a gross floor area of 43,300 m², combining a healthy blend of residential and retail space. The Burke will be constructed to a LEED® gold standard, leveraging green building practices and environmentally sound solutions.

- The Company was awarded two contracts for civil works on two separate sites: construction of two storm and effluent ponds at an existing project site in northwestern British Columbia, and construction of an overpass in northern Alberta. The combined value of the contracts awarded is approximately $135.0 million.

- The Company was awarded a three-year contract with a two-year extension option for mechanical and electrical maintenance services for the North West Redwater Partnership. The total value of the multi-year contract awarded is potentially up to $75 million.

- The Board has declared an eligible dividend of $0.0325 per common share for each of July 2021, August 2021, September 2021 and October 2021.

- Subsequent to quarter end, the Company announced that it was awarded the following project:

- The Company has negotiated a construction services contract with the international real estate firm Hines for a mixed-use project in the heart of Toronto, Ontario. The project is a 17-storey mixed-use building located near the corner of King street and Bathurst street. The new building will be constructed by leveraging green building practices with sustainable solutions.

CONFERENCE CALL AND WEBCAST

Bird will host an investor webcast to discuss the quarterly results on Wednesday, August 11, 2021 at 10:00 a.m. ET, to discuss the Company’s results. Analysts and investors may connect to the webcast via URL at http://services.choruscall.ca/links/bird20210811.html. They may also dial 1-855-328-1925 for audio only or to enter the question queue; attendees are asked to be on the line 10 minutes prior to the start of the call. The presentation can also be found on our website at https://www.bird.ca/investors.

The Company’s financial statements and Management’s Discussion & Analysis will be filed and available on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and on the Company’s website at www.bird.ca.

NON-GAAP MEASURES

Adjusted Earnings, Adjusted Earnings Per Share, Adjusted EBITDA, and Adjusted EBITDA Margin have no standardized meaning under IFRS and are considered non-GAAP measures. Therefore, these measures may not be comparable with similar measures presented by other companies.

Management uses Adjusted Earnings and Adjusted EBITDA to assess the operating performance of its business. Management believes that investors and analysts use these measures, as they may provide predictive value to assess the ongoing operations of the business and a more consistent comparison between financial reporting periods.

Adjusted Earnings and Adjusted EBITDA are reconciled as follows:

Additional information on these non-GAAP measures is provided in the section “Terminology & Non-GAAP Measures” in Bird’s most recently filed Management’s Discussion & Analysis for the period ended June 30, 2021, prepared as of August 10, 2021. This document is available on Bird’s SEDAR profile, at www.sedar.com and on the Company’s website at www.bird.ca.

FORWARD-LOOKING INFORMATION

This news release contains forward-looking statements and information ("forward-looking statements") within the meaning of applicable Canadian securities laws. The forward-looking statements contained in this news release are based on the expectations, estimates and projections of management of Bird as of the date of this news release unless otherwise stated. The use of any of the words "believe", "expect", "anticipate", "contemplate", "target", "plan", "intends", "continue", "may", "will", "should" and similar expressions are intended to identify forward- looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning: the anticipated benefits of the acquisition to Bird, its shareholders, and all other stakeholders, including anticipated synergies; and the plans and strategic priorities of the combined company.

In respect of the forward-looking statements concerning the anticipated benefits of the Stuart Olson acquisition (the “Transaction”), Bird has provided such in reliance on certain assumptions that it believes are reasonable at this time, including in respect of the combined company's services and anticipated synergies, capital efficiencies and cost- savings.

Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to the risks associated with the industries in which the Company operates in general such as: operational risks, industry and inherent project delivery risks; delays or changes in plans with respect to growth projects or capital expenditures; costs and expenses; health, safety and environmental risks; commodity price, interest rate and exchange rate fluctuations; compliance with environmental laws risks; competition, ethics and reputational risks; ability to access sufficient capital from internal and external sources; global pandemics; repayment of credit facility; collection of recognized revenue; performance bonds and contract security; potential for non-payment and credit risk and ongoing financing availability; regional concentration; regulations; dependence on the public sector; client concentration; labour matters; loss of key management; ability to hire and retain qualified and capable personnel; subcontractor performance; unanticipated shutdowns, work stoppages, strikes and lockouts; maintaining safe worksites; cyber security risks; litigation risk; corporate guarantees and letters of credit; volatility of market trading; failure of clients to obtain required permits and licenses; payment of dividends; economy and cyclicality; Public Private Partnerships project risk; design risks; completion and performance guarantees/design-build risks; ability to secure work; estimating costs and schedules/assessing contract risks; quality assurance and quality control; accuracy of cost to complete estimates; insurance risk; adjustments and cancellations of backlog; joint venture risk; internal and disclosure controls; Public Private Partnerships equity investments; failure to realize the anticipated benefits of the Transaction; and changes in legislation, including but not limited to tax laws and environmental regulations.

The forward-looking statements in this news release should not be interpreted as providing a full assessment or reflection of the unprecedented impacts of the recent COVID-19 pandemic ("COVID-19") and the resulting indirect global and regional economic impacts.

Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of the parties, and the combined company, including any risk factors related to COVID-19, are included in reports on file with applicable securities regulatory authorities, including but not limited to; Bird's Annual Information Form and Management’s Discussion and Analysis for the year ended December 31, 2020 and most recently filed Management’s Discussion and Analysis, each of which may be accessed on Bird’s SEDAR profile, at www.sedar.com and on the Company’s website at www.bird.ca.

The forward-looking statements contained in this news release are made as of the date hereof and the Company undertakes no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as, and to the extent required by applicable securities laws.

The Toronto Stock Exchange does not accept responsibility for the adequacy or accuracy of this release.

For further information, please contact:

T.L. McKibbon, President & CEO or

W.R. Gingrich, CFO

Bird Construction Inc.

5700 Explorer Drive, Suite 400

Mississauga, ON L4W 0C6

Phone: (905) 602-4122

ABOUT BIRD CONSTRUCTION

Bird (TSX: BDT) is a leading Canadian construction company operating from coast-to-coast and servicing all of Canada’s major markets. Bird provides a comprehensive range of construction services from new construction for industrial, commercial, and institutional markets; to industrial maintenance, repair and operations services, heavy civil construction, and mine support services; as well as vertical infrastructure including, electrical, mechanical, and specialty trades. For over 100 years, Bird has been a people-focused company with an unwavering commitment to safety and a high level of service that provides long-term value for all stakeholders. www.bird.ca